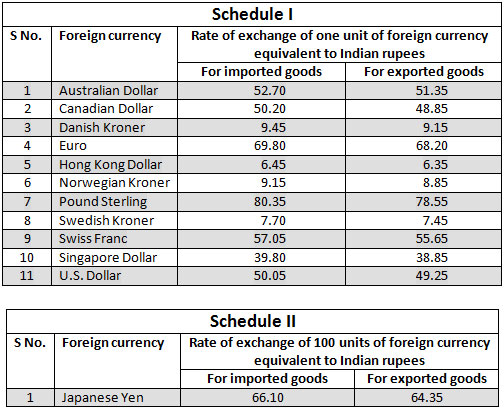

“Before putting in place this mechanism, banks will be required to take prior approval from the Foreign Exchange Department of Reserve Bank of India, Central Office at Mumbai,” it said. “In order to promote growth of global trade with emphasis on exports from India and to support the increasing interest of global trading community in INR, it has been decided to put in place an additional arrangement for invoicing, payment, and settlement of exports / imports in INR,” the RBI said in a notification. However, banks acting as authorised dealers for such transactions would have to take prior approval from the regulator to facilitate this.

The Reserve Bank of India (RBI) has put in place a mechanism to facilitate international trade in rupees (INR), with immediate effect.

0 kommentar(er)

0 kommentar(er)